Infinity Strategic Group

POSSIBILITIES ARE

INFINITE

WHEN YOU PLAN.

Hello!

You may think that estate planning is only for the wealthy. In reality, estate planning is a process that ensures you take care of the people and things that give your life meaning, regardless of how much money you have. Imagine for

a moment the peace you would feel knowing that the people you love most—spouse, children, parents, brothers, and sisters—would be protected and provid-ed for, even after you are gone. Estate planning also allows you to take care of yourself, by deciding how you want to live in the later years of your life and who will make decisions about your health and finances as you age.

If you have not yet gone through probate after the death of a family member, you can consider yourself lucky. Few who experience probate wish to repeat it. We can design an estate plan that eliminates the need for probate entirely, saving your family members both time and money in their time of grief. I also provide comprehensive, compassionate probate administration services to heirs of those without estate plans, or for adults who become disabled.

An estate plan is a loving gift that you give to your children, loved ones, friends, and your older self. The best estate plans are specifically designed to meet your needs and promote your dreams. At Infinity Strategic Group, we are committed to helping you plan for your future so that you can rest easy now. Give me a call to discuss the infinite possibilities available to you when you plan for the future.

Cheers!

Our Services

ESTATE PLANNING SERVICES

Collaborative planning for peace of mind

HOW OTHERS HAVE PLANNED STATES WITH ISG

- A married mother of two retained ISG to draft advanced directives for her aging mother, allowing her to manage her mother’s bank account, pay her bills, and assist in making her healthcare decisions.

- A single mother of three used ISG to draft a will so she could name guardians for her two daughters and son.

- A couple with treasured pets set up trusts through ISG to ensure that their furbabies will always be protected and cared for.

- Business partners worked with ISG to identify new owners for their business after retirement.

- A mother who had been through the grueling probate process with her parent, and did not want to burden her own children with it, set up a trust with ISG.

- A charitable family with several favorite causes worked with ISG to make a positive impact now and ensure a lasting legacy after death.

Our Services

PROBATE AND TRUST ADMINISTRATION

What is probate?

Probate is a court proceeding before a judge used to formally transfer assets from a deceased person to his or her heirs.

Probate is required in the state of Illinois whether the deceased person had a will or not. However, with a will in place, probate is much faster and easier. The executor named in your will will ensure that your assets are inherited according to your wishes. Without a will, the state of Illinois will make one for you and your assets will be distributed according to Illinois statute.

Probate can be avoided altogether with a specially designed estate plan.

WHAT WILL MY HEIRS EXPERIENCE?

WHAT CAN YOU PROTECT WITH A WILL OR TRUST?

What are trusts and wills?

There are several types of trusts, but all of them allow you to maintain control over your assets during your lifetime, take advantage of tax benefits, plan for family members with special needs, and simply, easily, and privately assign responsibility for your assets to a trusted friend or family member upon your death or incapacitation.

A will is a simpler document that describes how to handle your assets after death, including naming an executor for your estate and a guardian for your children. Without a will, the state will decide what happens to your assets and dependents. Smart estate planning can include both a trust and a will – they are not mutually exclusive.

WHY CREATE A TRUST?

- To better understand your assets. Clients with a living trust centered plan have a better understanding of how their assets are titled and should be distributed.

- To plan for incapacity. With a living trust, you choose a trusted friend or family member who will execute your desires if you become disabled.

- To avoid probate and publicity. With a living trust, there is no need for probate administration. Since a trust is not a public document, the details of your estate plan will remain private.

- To help with Medicaid planning. If you become ill and need to enter a Medicaid facility, the state of Illinois could become the beneficiary of your home and assets – unless you have a trust.

- To allow you to make a long-term positive impact. A trust can provide distributions to loved ones and favored charities for years after your own death.

- To take advantage of tax benefits.

DRAFTING A WILL OR TRUST

Barring unexpected delays, it takes two weeks to draft your will or trust, one week to review, and one additional week to sign and finalize, for a total of only four weeks* from our initial meeting to the final signing of paperwork.

* Timeframe may be extended based on client availability/responsiveness

Our Services

TAX PLANNING

Comprehensive tax solutions

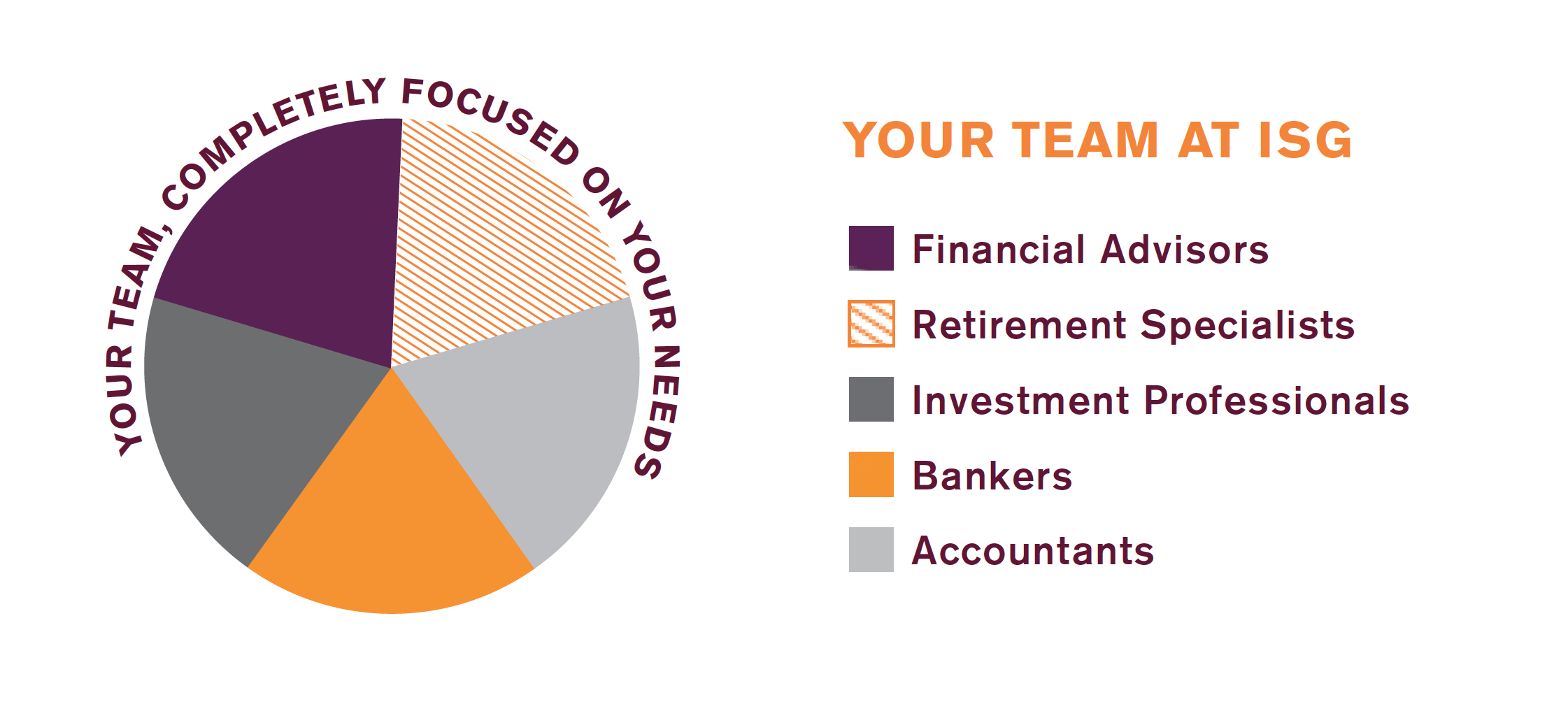

The legal team at ISG works with you, your family, and trusted advisors to explore and implement tax-advantaged transfers to your children or favorite organizations.

We work with a mix of highly credentialed attorneys, financial experts, and other professionals with specialized knowledge and experience to provide the best advice for your unique circumstances.

THE ADVANTAGE OF WORKING WITH ISG.

We use flexible staffing arrangements to partner with specialized professionals. That way, we can offer you the highest quality legal services at competitive rates.

If you want to go far, go together.

– African Proverb

together we can do so much.

– Helen Keller

Testimonials

WHAT OUR CLIENTS SAY

About

ABOUT ABOSEDE ODUNSI

Owner and Principal of Infinity Strategic Group

Abosede is a compassionate champion for women, families, and businesses who wish to plan for their future and legacy.

For more than 10 years, Abosede and ISG have offered clients the potential for infinite possibilities in life – and the peace of mind that comes with strategic estate planning.

Education

- Northwestern Pritzker School of Law, LL.M, Taxation

- University of Wisconsin Law School, Juris Doctor

- The Pennsylvania State University, Master of Arts

- University of Illinois at Champaign-Urbana, Bachelor of Arts

- DePaul University, Certified Financial Planner Certificate

Contact & Location

Let's Connect

180 N. Stetson Avenue, #3500 Chicago, IL 60601

+ 312.268.5625

aodunsi@infinitystrategicgroup.com

+ 312.268.5801